Traders who want to stay on top of their game need to be familiar with tick data. Tick data is a real-time record of transactions and prices in the financial markets, enabling traders to make faster, more informed decisions about when to buy and sell. Learn about the importance of tick data, how it works and how you can access it.

What Is Tick Data?

Tick data is a time-stamped record of all transactions and prices at any given moment in the financial markets. Traders can use tick data to understand the most recent price movements in order to make informed trading decisions. It is especially useful for short-term traders who are looking for quick gains and want to avoid getting stuck with large losses.

Why Tick Data Is Important

Tick data is essential for traders because it gives them deeper insight into the dynamics of any given market or asset. It provides an accurate representation of market conditions and allows traders to gain a clear understanding of where price is heading. By using tick data to analyze order flow, liquidity, and momentum, traders can make better decisions about their trading strategies which in turn increases their chances of success.

The Benefits of Utilizing Tick Data

There are many benefits to utilizing a tick database when trading. First, it helps traders get a better picture of the current market trends, enabling them to spot possible opportunities and hone their strategies accordingly. Furthermore, it also helps traders develop a better understanding of the liquidity of any given asset. By looking at how frequently prices change and orders get filled, traders can determine whether it is worth investing in that particular asset or not. Finally, it helps traders make smarter decisions by providing timely information about trend reversals and price movements.

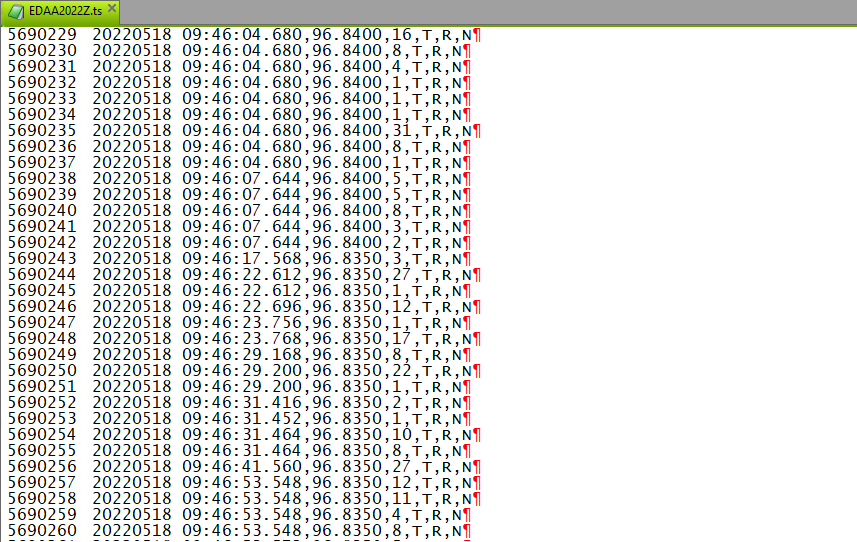

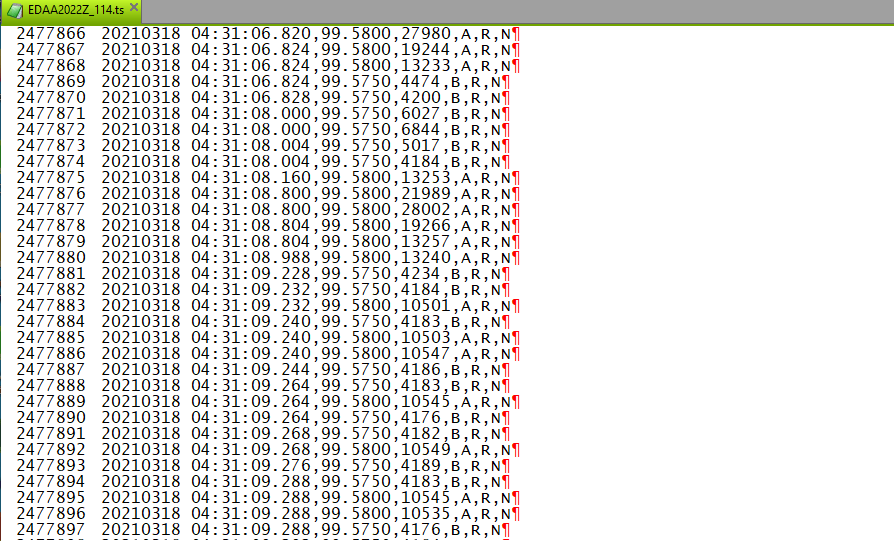

Understanding Time & Sales Data

Time & Sales data is an important component of tick data. It displays the movement in price and volume for each individual transaction over a given period of time. Traders can use this information to determine order flow, volatility, liquidity, and momentum. By analyzing these figures, traders are able to get a better idea of where the market is headed in the near term and if their chosen trade will likely be profitable.

How to Access High-Quality Data

Accessing high-quality tick data is one of the most important steps a trader can take when trying to gain an edge in the markets. Fortunately, there are a variety of reliable sources that offer access to high-quality data, such as dedicated data providers (such as Portara), broker platforms (such as Interactive Brokers), and public APIs. It’s important to research your options carefully in order to get the best quality data at the most competitive price.

You can browse our collection of tick trades and level 1 tick databases by following the links below:

- Tick Trades Only

- Tick Level 1 (includes: Bids, Asks, Trades and Settle)