When it comes to trading, having access to accurate and timely data is crucial. Two types of data that traders often use are tick data and time-based data. But which one should you prioritize? In this article, we’ll compare the two and provide insights to help you make the right choice for your trading strategy.

Understanding the difference between tick data and time-based data

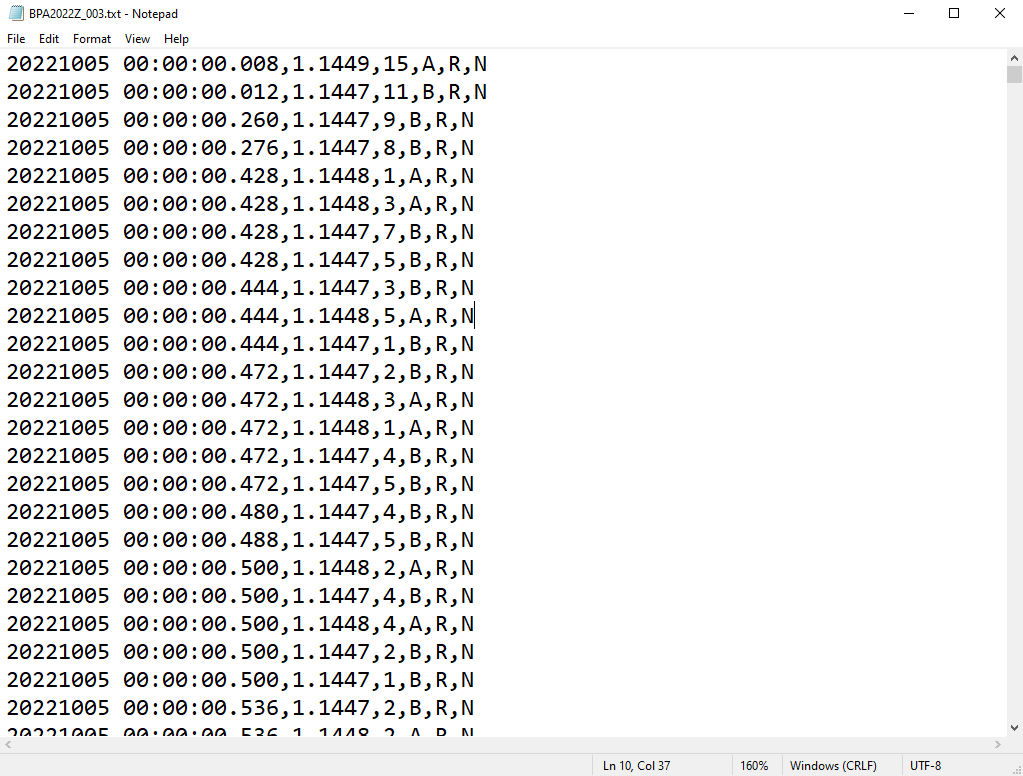

Tick and time-based data are both important for trading, but they differ in how they are collected and presented. Tick data records every transaction that occurs in the market, while time-based data records the price at a specific time interval, such as every minute or every hour. Tick provides more detailed information on market activity, whereas time-based data provides a broader overview of market trends. Understanding the differences between these two types of data can help you make more informed trading decisions.

The advantages and disadvantages of using tick data

Tick data provides traders with a more detailed view of market activity, allowing them to see every transaction that occurs in real-time. This can be particularly useful for high-frequency traders who need to make split-second decisions based on market movements. However, tick data can also be overwhelming and difficult to analyze, especially for novice traders. Additionally, it can be more expensive to obtain and may require specialized software to process. It’s important to weigh the benefits and drawbacks of before deciding whether it’s the right choice for your trading strategy.

The advantages and disadvantages of using time-based data

Time-based data, on the other hand, provides traders with a more simplified view of market activity. This type of data is based on a set time interval, such as one minute or five minutes, and provides traders with a snapshot of market activity during that time period. Time-based data is easier to analyze and can be more cost-effective. However, it may not provide as much detail, which could be a disadvantage for some traders. Ultimately, the choice between tick and time-based data depends on your trading strategy and personal preferences.

How to choose the right data for your trading strategy

Choosing the right data for your trading strategy depends on several factors, including your trading style, risk tolerance, and the type of market you are trading in. If you are a high-frequency trader, tick may be more suitable for you as it provides more granular information. However, if you are a swing trader or position trader, time-based data may be sufficient for your needs. It’s important to consider the pros and cons of each type of data and test them out in your trading strategy to see which one works best for you.

Tips for using tick data and time-based data effectively

When using tick data, it’s important to remember that it can be more volatile and prone to noise than time-based data. To mitigate this, consider using tick in conjunction with other indicators or filters to confirm signals. However, when using time-based data, be aware that it may not capture all the price movements within a given period. To address this, consider using multiple time frames to get a more complete picture of the market. Ultimately, the key is to experiment with both types of data and find the approach that works best for your trading style and goals.