Welcome to the Dutch TTF Natural Gas market (futures symbol TTF), where we’ll explore how this innovative system works and what it means for energy consumers. The Dutch TTF (Title Transfer Facility) has become one of the most influential and sought-after trading platforms in the global natural gas market.

With its transparent and efficient pricing mechanisms, the Dutch TTF Natural Gas market sets the benchmark for pricing natural gas across Europe. It operates as a virtual trading point, allowing buyers and sellers to exchange natural gas contracts. This flexibility and simplicity have attracted market participants from around the world.

The Dutch Natural Gas market’s success lies in its ability to provide reliable pricing signals and enable secure and transparent transactions. It has emerged as a key player, facilitating the transition towards more sustainable energy by promoting liquidity and competition.

What is Dutch TTF Natural Gas?

The Dutch TTF is a virtual trading hub located in the Netherlands. It serves as Europe’s leading natural gas marketplace, facilitating the trade of natural gas contracts. The TTF acts as a central point where buyers and sellers can exchange gas contracts based on transparent and market-driven prices.

The TTF operates as a Title Transfer Facility, which means that ownership of natural gas can be easily transferred without the physical movement of the gas itself. This virtual trading mechanism has revolutionized the natural gas market, enabling participants to trade gas contracts efficiently and securely.

How Dutch TTF Natural Gas works

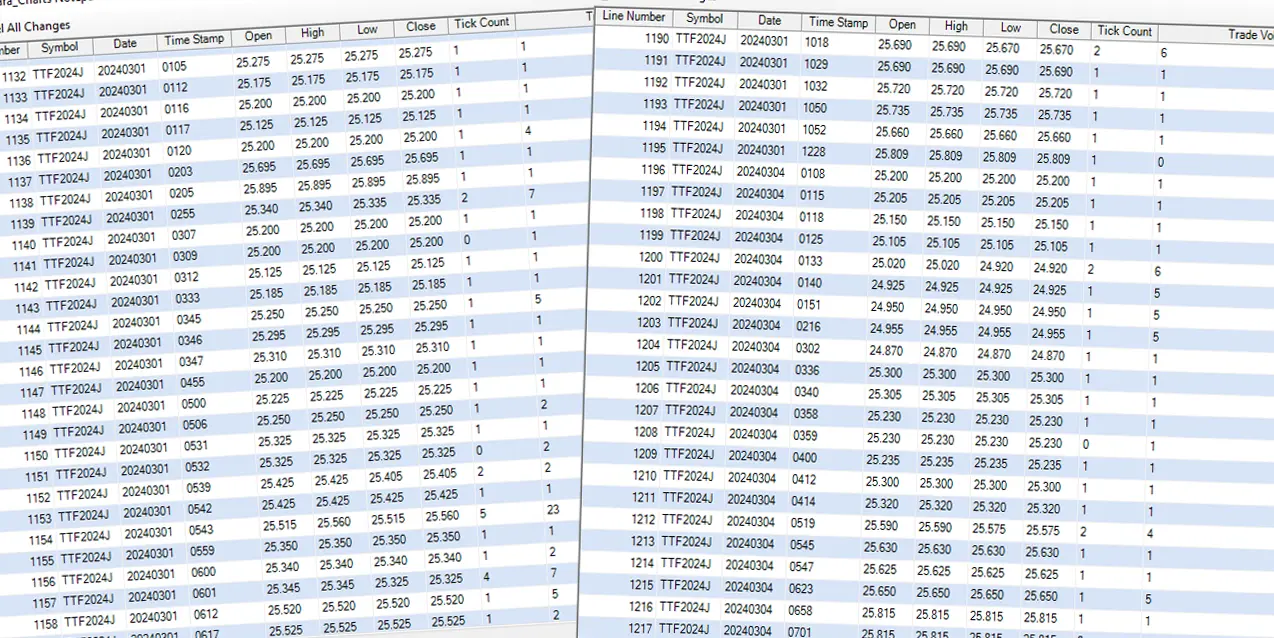

The Dutch TTF Natural Gas market operates as a virtual trading point, where participants can buy and sell natural gas contracts. These contracts represent the right to buy or sell natural gas at a specified price and delivery date.

The trading process begins with market participants submitting bids and offers for natural gas contracts. These bids and offers are matched by the trading platform, and trades are executed based on the best available prices. The TTF provides a transparent and efficient marketplace for price discovery and trade execution.

Once a trade is executed, the buyer and seller agree on the terms of the contract, including the volume of gas, price, and delivery date. The TTF acts as a neutral intermediary, ensuring the smooth settlement of trades and the transfer of ownership rights.

The TTF also provides a range of financial instruments, such as futures and options, which allow market participants to hedge their price risks and manage their exposure to natural gas prices. These instruments enhance market liquidity and provide flexibility to market participants.

The role of TTF in the European gas market

The Dutch TTF Natural Gas market plays a crucial role in the European gas market. It has emerged as the preferred pricing benchmark for natural gas in Europe, influencing gas prices across the continent.

The TTF’s transparent pricing mechanisms and efficient trading infrastructure have attracted market participants from all over Europe and beyond. Gas producers, suppliers, and traders use the TTF as a reference point for pricing their gas contracts. The TTF’s reliable and market-driven prices provide a fair and competitive basis for gas trading in Europe.

Pricing and trading of Dutch TTF Natural Gas

Dutch TTF Gas pricing is determined by supply and demand dynamics in the market. Market participants submit bids and offers based on their assessment of the market conditions and their trading strategies.

The TTF uses an auction mechanism to match these bids and offers and determine the market-clearing price. This price represents the point at which the quantity of gas supplied matches the quantity demanded.

The TTF’s pricing mechanism is transparent and market-driven, allowing participants to make informed decisions based on real-time market information. The TTF publishes price indices that reflect the market conditions, providing transparency and facilitating price discovery.

Benefits & challenges of TTF nat gas

Pros

- Price Transparency

- Market Liquidity

- Flexibility

- Competition

Cons

- Price Volatility

- Strict Regulations & Compliance

Comparison with other gas trading hubs

The Dutch TTF Gas market is often compared to other gas trading hubs around the world, such as the British NBP (National Balancing Point) and the American Henry Hub.

While these gas trading hubs have their unique characteristics, the TTF stands out for its transparent pricing mechanisms, efficient trading infrastructure, and its role as Europe’s leading gas marketplace. This success can be attributed to its ability to attract market participants, provide reliable pricing signals, and facilitate secure transactions.

Conclusion

The Dutch TTF market has revolutionized the trading of natural gas in Europe. With its pricing mechanisms, infrastructure, and role as a virtual trading point, the TTF has become the benchmark for pricing natural gas across Europe. It promotes liquidity, competition, and transparency in the gas market, while also encouraging the transition towards more sustainable energy sources.

As the energy landscape continues to evolve, the TTF will continue adapting and innovating to meet the changing needs of market participants and energy consumers. With its track record of success and commitment to excellence, the Dutch TTF Natural Gas market will remain a key player in the global natural gas market for years to come.