Daily data is a vital aspect of the financial and commodities markets, providing traders, investors, and analysts with crucial information about the trading activities of futures contracts on a day-to-day basis. This data encompasses various metrics and insights that help market participants make informed decisions, manage risks, and strategize effectively.

Key Components of Daily Data

Price Data:

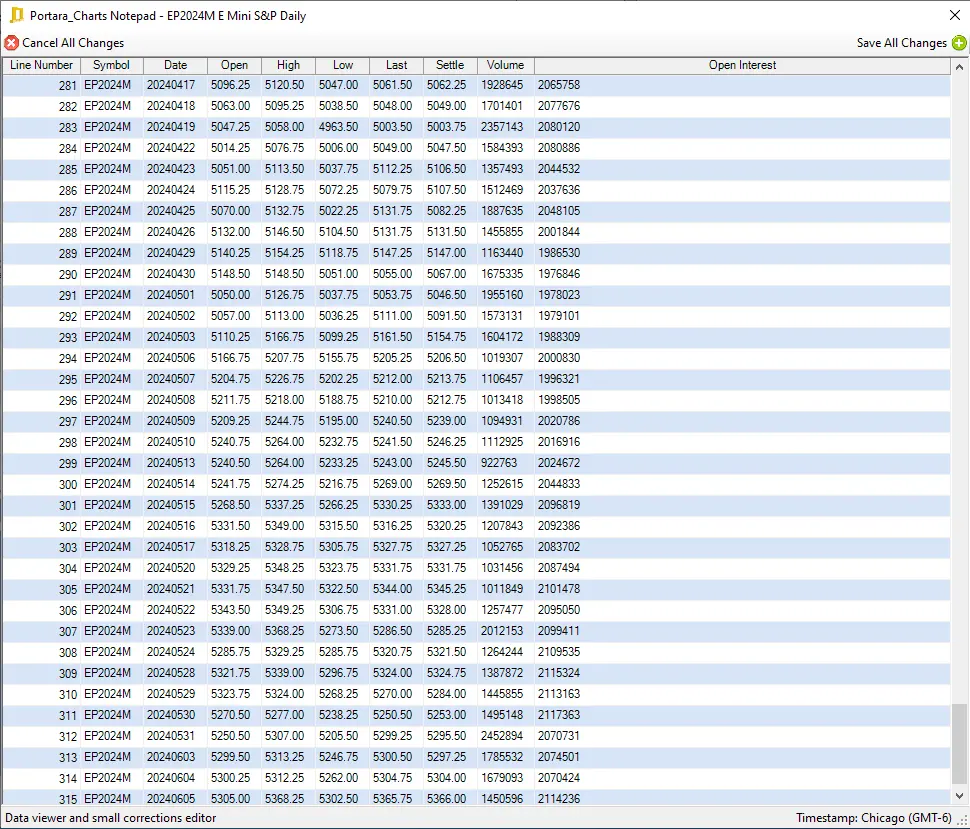

- Opening Price: The price at which a futures contract begins trading when the market opens.

- High and Low Prices: The highest and lowest prices reached by a contract during the trading day.

- Closing Price: The last price at which the contract is traded before the market closes.

- Settlement Price: The official closing price determined by the exchange, used for marking positions to market and calculating daily gains and losses.

Volume Data: The total number of contracts traded during the day. High volumes typically indicate strong interest and liquidity in the market, while low volumes may suggest lower liquidity and potential volatility.

Open Interest: The total number of outstanding futures contracts that have not been settled. Open interest data helps in understanding the flow of money into and out of the futures market, indicating the strength of market trends.

Difference between settlement price and closing price

There are a handful of differences between the settlement and closing prices:

- Calculation: The closing price is the last traded price before the market closes, while the settlement price is an average of prices over a specified period, calculated by the exchange.

- Purpose & Usage: The closing price provides a quick reference for the end-of-day trading price, while the settlement price is used for official purposes such as margin calculations, daily profit and loss, and regulatory reporting.

- Volatility: The closing price can be more volatile as traders often scramble to secure trading positions before the market closes, whereas the settlement price aims to represent a fair market value by taking an average of the contract price within the final minutes of trade. The exact time for averaging varies between exchanges but the effect remains the same: reducing the impact of any anomalies in the final trades.

Importance of Daily Data

Market Analysis and Forecasting

Daily data is essential for analyzing market trends and forecasting future price movements. By examining price patterns, volumes, and open interest, traders can identify trends and reversals, helping them to make more accurate predictions about where the market is headed.

Risk Management

For both individual traders and institutional investors, managing risk is a critical aspect of trading. Daily data provides the necessary information to assess market conditions and potential risks. By understanding price volatility and market sentiment, traders can implement appropriate risk management strategies, such as setting stop-loss orders or adjusting position sizes.

Decision Making

Informed decision-making is the cornerstone of successful trading. Daily data offers a wealth of information that traders can use to make educated decisions about entering or exiting positions. This data helps in determining the best times to buy or sell, optimizing trading strategies, and enhancing overall profitability.

Liquidity Assessment

Liquidity is a crucial factor in trading futures contracts. High trading volumes and narrow bid-ask spreads typically indicate a liquid market, making it easier for traders to execute orders quickly and at favorable prices. Conversely, low liquidity can lead to increased volatility and higher trading costs. Daily data helps traders assess the liquidity of specific contracts and markets.

Regulatory Compliance

For institutional investors and funds, compliance with regulatory requirements is essential. Daily data, including settlement prices and COT reports, helps these entities meet reporting and compliance obligations. Accurate and timely data ensures transparency and adherence to regulatory standards.

Strategic Planning

Long-term investors and hedgers use daily data for strategic planning. By analyzing trends and market conditions, they can develop and adjust their investment or hedging strategies to align with market realities. For example, a company looking to hedge against future price fluctuations in raw materials can use futures data to time their hedging activities effectively.

Where to find daily data

One option is to use a trading platform such as ninjatrader, which provides this data as part of its service. Many platforms offer historical data as a premium feature, so traders may need to pay a fee to access it. Another option is to use a data provider that specializes in historical market data, such as PortaraCQG. You can browse our full range of daily data, including cme historical settlement prices by visiting our Daily Database.

Conclusion

Daily data is a cornerstone of the futures markets, providing a comprehensive view of trading activities and market conditions. By leveraging this data, market participants can enhance their market analysis, improve risk management, make informed decisions, and strategically plan their trading and investment activities. Understanding and utilizing daily futures data is essential for success in the dynamic world of futures trading.