Dynamic Flexible Methods:

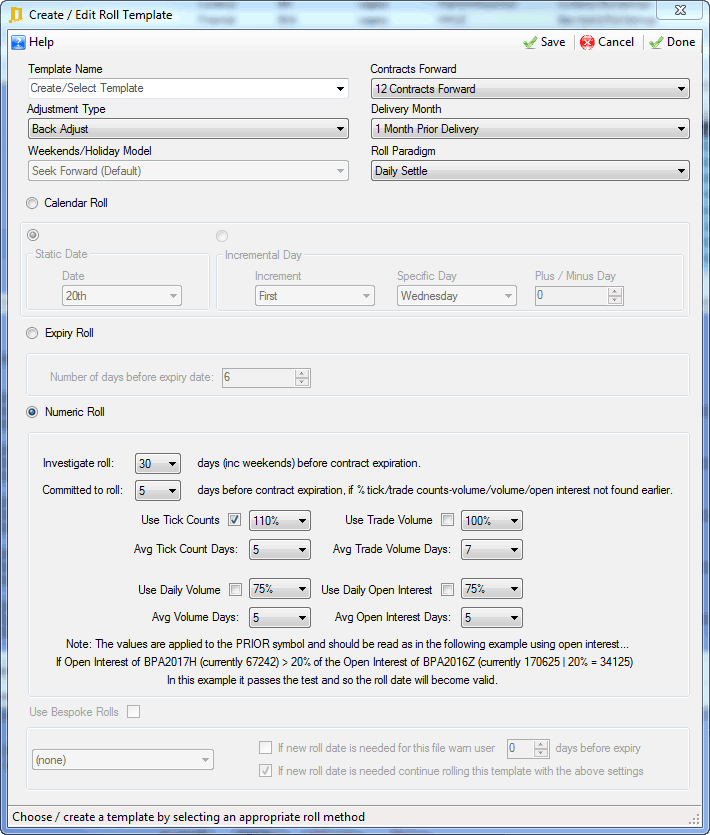

Roll Templates allow you to choose how to roll your contracts into a continuous stream of data. You can choose to utilise Portara’s roll logic, by daily volume, daily open interest, tick count trade volume and by various calendar roll methods.

Backadjusted, ratio adjusted, forward and zero adjusted methods are all catered for.

You may choose to roll with reference to the intraday custom end-of-session that suits you or roll at the standard daily settle. It is all possible.

Skip holidays and weekends and seek next-forward or previous-backward to pick up the roll date method that suits you.

Short term interest rate products (STIR) contracts, and indeed all contracts, can be pushed further out than the nearest future where the liquidity and volatility are higher.

There is a CSV import facility whereby you can import your own set of custom roll dates for each symbol from an excel spreadsheet/txt file meaning that you can roll using your own dates outside of the Portara user-interface and have independent control.

Learn more about the roll manager.