Historical Daily Cocoa (ICE) Futures Data CCE (CCE)

Cocoa (ICE) Contract Specs:

| Cocoa (ICE) (CCE) | |

| AKA: | Cocoa (ICE) |

| Exchange Name: | ICE Futures US Softs |

| Exchange: | NYI |

| Sector: | Soft |

| Tick Size: | 1 |

| BPV: | 10 |

| Denomination: | USD |

| Bloomberg Symbol: | |

| CSI Symbol: | CCE |

| Ninjatrader Symbol: | CCE |

Buy Cocoa (ICE) Futures Data CCE (CCE)

Purchase Cocoa (ICE) Futures Data CCE (CCE) from PortaraCQG. Our tailored service includes your format options. ALL data is created for you by a qualified trader. We provide expert guidance if you are unsure. we will email you when your purchase has completed with roll/format options to choose from.

CCE (CCE) Historic Futures Data: Available

| Data Type | Start Date | End Date | Size | Sample Data |

| Daily: | 1979 Dec 19 | Current | < 50 KB | Download |

| Intraday: | Current | |||

| Tick - Trades Only: | Current | |||

| Tick - Level 1: | Current |

Or Subscribe To Portara Downloader

Get access to our 'historical futures and forex data cloud'. Simply ‘drag & drop’ daily, intraday, tick and level 1 quote data straight to your desktop, whenever you need it! You can format the data on the fly.

Watch this video for further information >>

Please note: The free-tier offer is currently unavailable.

Crude Oil Futures & The Future Of Renewable Energy

What is daily data & Why is it important?

Format Details for Cocoa (ICE) CCE (CCE)

Format Details for Cocoa (ICE) CCE (CCE)

Alternative Cocoa (ICE) Symbology:

Other companies can refer to the Cocoa (ICE) symbols by the following symbol names: CCE CCE .

Portara and CQG provide historical intraday futures data to CTAs, hedge funds, portfolio managers, quants and traders and institutions.

Portara's Main Data Products

Cocoa (ICE) futures data can be split into four main headings:

- Daily data - which includes either the last price or the settlement

- Intraday data – which includes trade volume

- Tick data – Trades Only - which includes only trades

- Tick data Level 1 - which includes the trades, the bid, the ask and the settle

Purchase Individual or Continuous form Data

You can purchase historical intraday CCE / CCE futures data as individual contracts or in a continuous form.

Continuous 1 minute CCE / CCE futures data can be formatted into back-adjusted, forward-adjusted, ratio adjusted and zero adjusted series. Portara can create bespoke rules for each futures CCE contract based on volume, open interest, tick size and calendar date variations. Control delivery month combinations, timezone settings and timestamps that follow exchange or local time globally for any location.

World's Only Data Supplier with FIVE DAILY Data Points

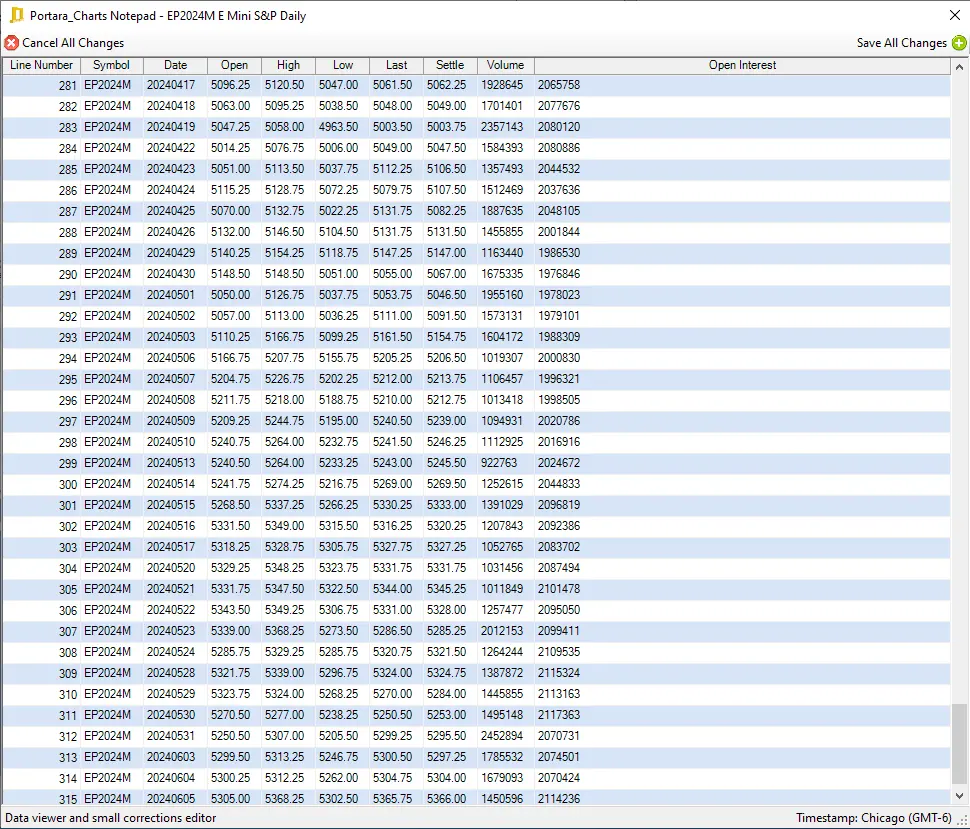

Portara’s standard Cocoa (ICE) daily futures data is made up of five data points – open, high, low, last-price and settle. Simply choose to have the daily close based on the last price or the settle depending on whether you wish follow extended sessions or just the day session.

CCE Data Granularity

Portara’s Cocoa (ICE) intraday futures data is supplied as default in 1-minute bar. However, you may also choose other bar granularities such as 2 minute bar, 3 minute bar, 5 minute bar, 10 minute bar, 15 minute bar, 30 minute bar, hourly bar etc. You can also have us extract daily Cocoa (ICE) data straight from the intraday database. In this case, you would choose the session (even if you need to cross midnight) and we can supply the custom Cocoa (ICE) daily futures data between only between the custom session markers you choose.

Portara provides CCE futures tick data in ‘Trades Only’ form or as ‘Level 1’ tick data, which includes the bids and asks. Download the tick data samples above. Our default format timestamp is to the millisecond. Cocoa (ICE) tick data includes price, the trade volume, and other trade indicators such as bid, ask, trade and settle.

Remember to compare the file size of trades only data to level 1 tick data as they can vary by factors of 10 to 100 fold. If you have questions simply email us and one of our technicians will guide you.

Updates

All of our historical data is updated on a daily basis up to four times per day based on your subscription level, at the end of the Asian, European, Early US and Globex session. Portara’s enterprise software solution provides timely updates to your data, along with compression, roll and custom formatting features on CQG deep history databases. Historical Cocoa (ICE) data updates are ready around half an hour after markets close. No exchange fees or other CQG products are necessary.

Portara's Catalogue of Historical Cocoa (ICE) Futures Data CCE

You can view other futures, forex, ETFs and fixed income symbols and commodities from the Historical Intraday Data Download Table. If you are looking for derivatives of the Cocoa (ICE) or any other historical data types such as daily or tick, you can visit the other download tables here:

- Historical Daily Data Download Table

- Historical Intraday Data Download Table

- Historical Tick - Trades Only Data Download Table

- Historical Tick - Level 1 Data Download Table

To discuss CCE / CCE Futures data or if you have any other enquiry please reach out to us using the widget in the bottom corner or our contact page if you have visited us via mobile phone.

Format Details for Cocoa (ICE) CCE (CCE)

Format Details for Cocoa (ICE) CCE (CCE)